Summary:

Whitelist Liquity LUSD Stability Pool and LQTY staking for Olympus treasury deposits.

Background:

OIP-20 defined a framework for Olympus where 33% of excess treasury reserves can be deposited to earn yield in whitelisted protocols. At the time of this writing, the whitelisted protocols are Aave, Compound, Convex, and Sushiswap(Onsen). This proposal seeks to add Liquity to this whitelist while keeping the same 33% treasury deposit cap.

Description from liquity.org:

Liquity is a decentralized borrowing protocol that allows you to draw 0% interest loans against Ether used as collateral. Loans are paid out in LUSD - a USD pegged stablecoin, and need to maintain a minimum collateral ratio of only 110%.

In addition to the collateral, the loans are secured by a Stability Pool containing LUSD and by fellow borrowers collectively acting as guarantors of last resort.

Liquity as a protocol is non-custodial, immutable and governance-free.

Specifics:

This proposal is only targeting the LUSD stability pool and LQTY staking on Liquity. LUSD would be deposited in the stability pool to earn LQTY. The earned LQTY would be staked to earn more LUSD and ETH. Liquidations in the platform use the stability pool’s LUSD to ensure the protocol is healthy. In doing so, ETH is provided and LUSD is taken. This is considered acceptable as the treasury already accumulates ETH and LUSD bonds can replenish any LUSD removed from our deposit.

Risks:

A vulnerability in the Liquity protocol could lead to partial or complete loss of funds. Severe liquidations could leave us with substantially less LUSD, but more ETH.

Protocol Analysis:

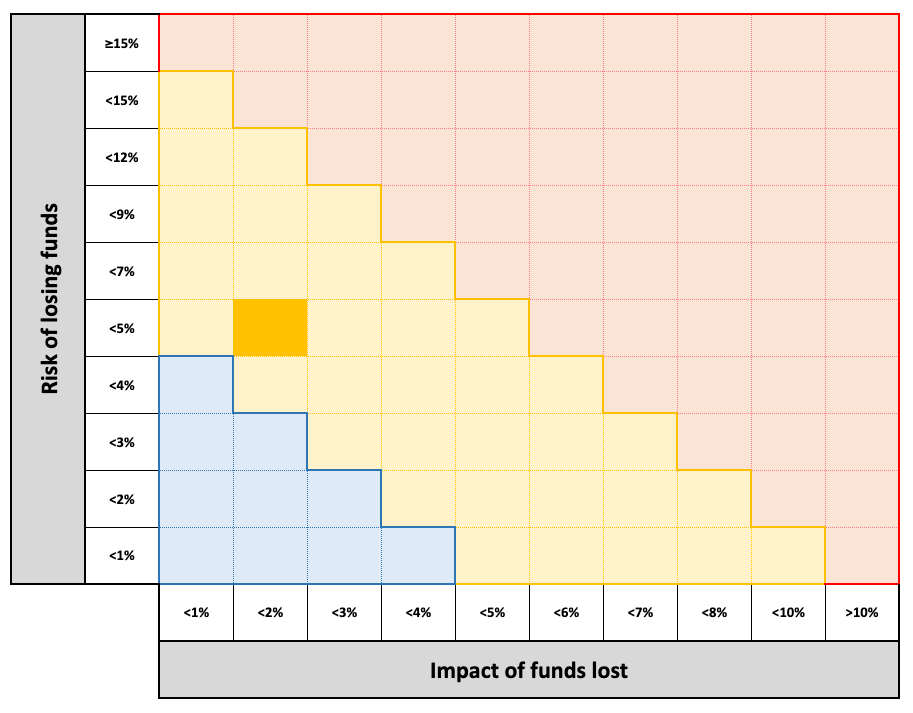

Using a risk analysis framework developed by the DAO, the Policy and Partnerships teams have attempted to score various protocols based on some subjective and non-subjective data. Liquity scored well in this regard. The subjective values were derived from averaging the votes of multiple DAO members.

The following risk matrix shows the outcome of the vote. The "Risk of losing funds" column refers to the chance that assets are lost before the initial investment doubles. The "Impact of funds lost" column refers to how much treasury value will be lost if an incident occurs. Lastly, one final reminder that this score was partially derived from a DAO-averaged subjective value.

Motivation:

Whitelisting Liquity will allow Olympus to begin accumulating LQTY which can then be staked for more LUSD and ETH. This also increases our chances for further Liquity partnerships in the future. Lastly, our funds in the stability pool would help ensure the long term success of the Liquity protocol.