Summary

The Thecosomata (Sea Butterfly) Treaty is a proposal by REDACTED CARTEL, an Olympus SubDAO, to use Olympus’s sOHM collateralized debt facility to borrow OHM to create more OHM : BTRFLY LP at a faster rate than LP bonds. On the Olympus side, it requires gOHM holders to approve the whitelisting of a specialist contract, called “Thecosomata.sol” to borrow OHM as needed (an OHMDEBTOR), to add LP. Thecosomata.sol will self-impose a 50% LTV limit.

Motivation

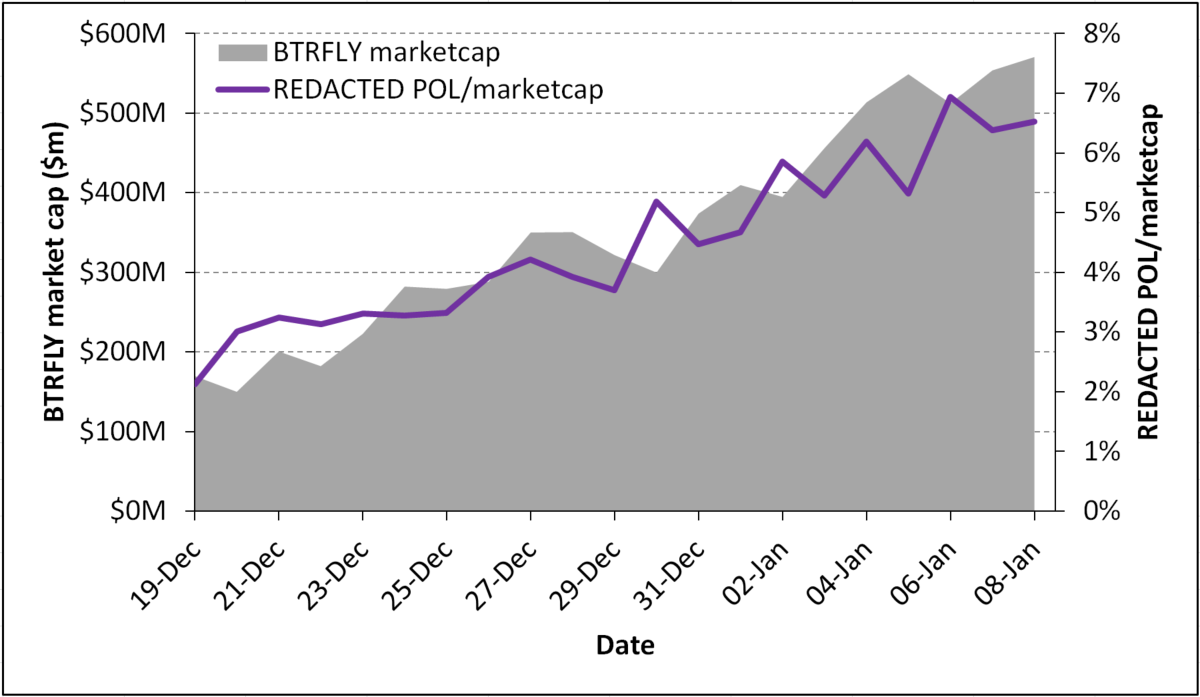

REDACTED CARTEL needs to greatly increase it’s POL to market cap ratio to offer cool defi products to it’s holders, such as lending/borrowing facilities, and grow its treasury. Currently the POL/MCap ratio is hovering around 6%, which is a third of what we need it to be.

With our market cap rising to $550M just 3 weeks after our TBE, we feel our existing LP bonds, which increase POL by $3M aren’t moving quickly enough. This is further exemplified by the majority of BTRFLY trade volume going through a competing ETH : BTRFLY pool on Uniswap V3. Assuming our market cap stayed the same while we waited for LP bonds to beef up POL, we would be in limbo for the next 3 weeks. 3 weeks in DeFi is like 3 months IRL.

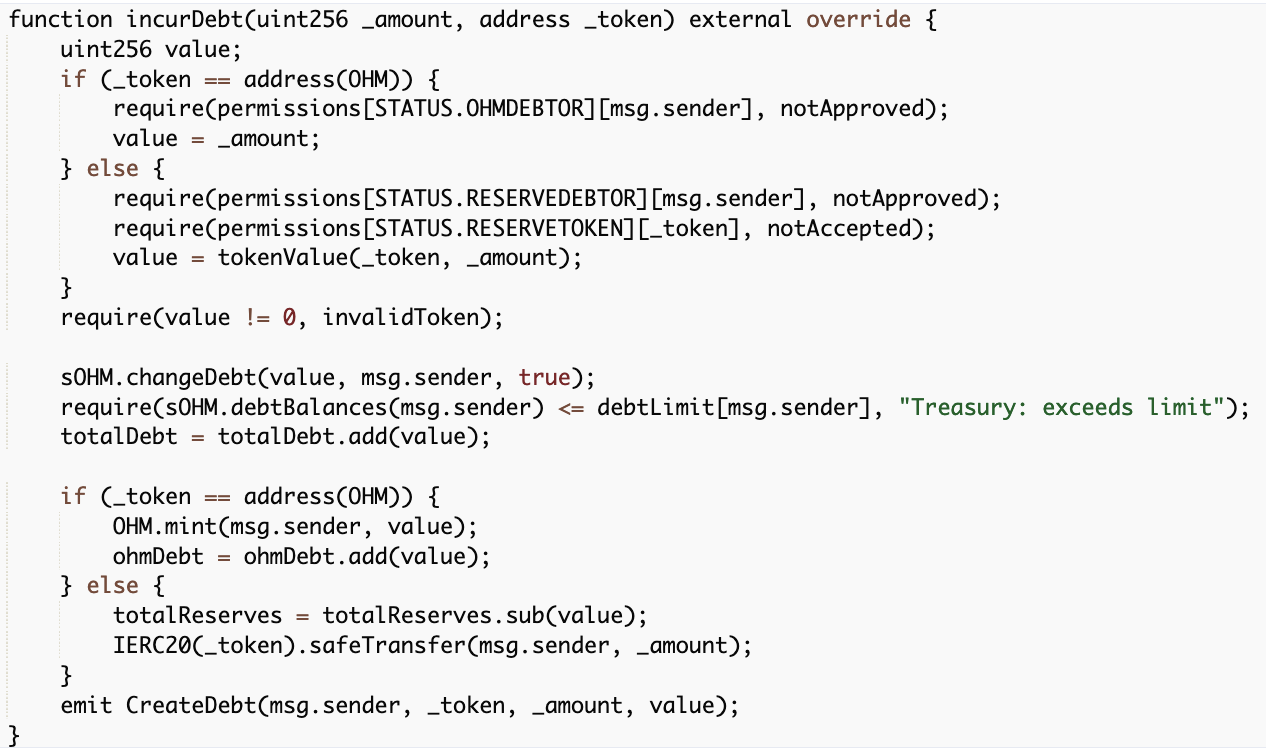

Thus, we need a quicker solution. Zeus recommended we consider a feature available in Olympus’s V2 Treasury - the incurDebt() function. This function enables us to borrow OHM on our sOHM collateral, provided we are whitelisted. Whilst there is an explicit debt limit configurable for each client of this facility - we are willing to voluntarily impose a 50% LTV limit as well.

We have roughly $19M of sOHM (67K sOHM) in our treasury (as of 8th January 2022), with a 50% TVL, we would be able to borrow $9.5M upfront to create $19M worth of liquidity. This amount would grow over time as we receive staking rewards on our sOHM. In addition, this could be supplemented by bonding OHM instead of LP, enabling us to grow LP at a minimum of the same rate - while capturing future upside on the asset we are bonding. This upside would enable us to borrow more in the future to create liquidity.

FOR MORE INFORMATION REGARDING THE THECOSOMATA TREATY, PLEASE SEE OUR MAIN PROPOSAL LIVE ON REDACTED CARTEL’S COMMONWEALTH.

Proposal

REDACTED CARTEL request that Thecosomata.sol, a special purpose contract being build to access Olympus DAO debt facility to create POL, is whitelisted for the “OHMDEBTOR” role. This would enable it to borrow OHM using sOHM as collateral.

Borrowing Parameters :

An initial absolute borrowing limit of 100K OHM

A self-imposed 50% LTV limit, within Thecosomata.sol that can only be increased in cooperation with Olympus DAO

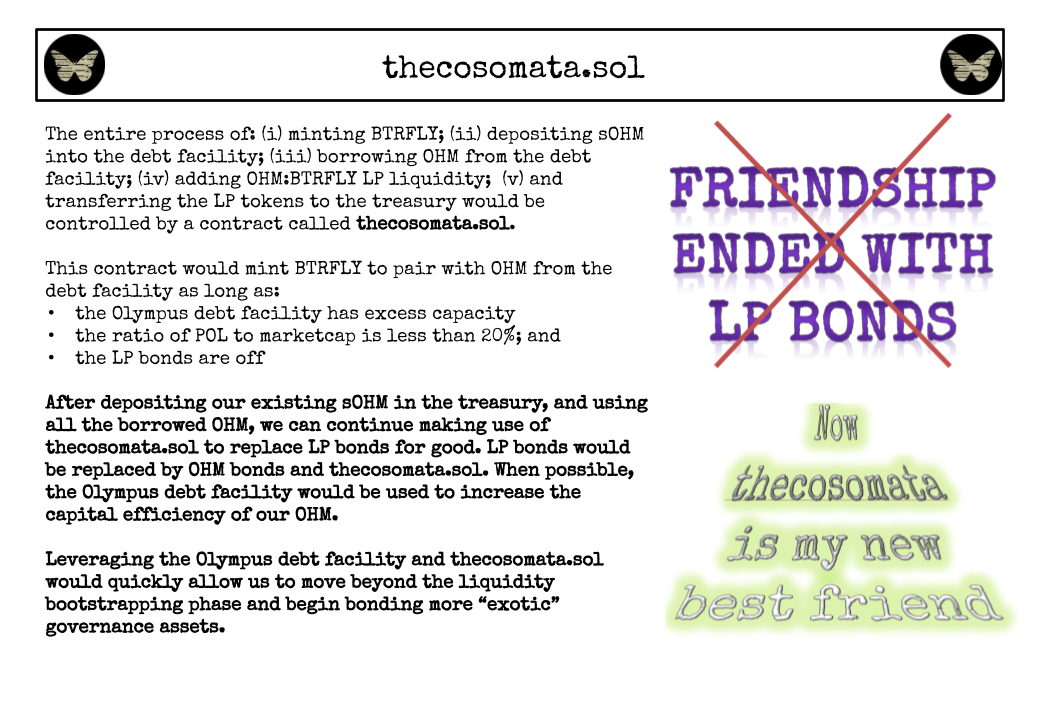

Daily Operation of Thecosomata (while REDACTED POL < 20% BTRFLY Mcap) :

Mint BTRFLY equivalent to 0.5% of current total supply

Borrow matching amount of OHM

Mint OHM : BTRFLY Sushiswap LP

Transfer LP back to treasury

Alongside this :

LP bonds will be turned off, whilst Thecosomata is active and POL < 20% MCap

OHM bonds will be pushed as the primary bonds within REDACTED whilst POL < 20% Mcap

Once POL hits 20% of MCap, REDACTED will begin diversifying bonds

Polling Period

The polling process begins now and will end at 12:00 on 12/01/22. After this, a scattershot vote will be put up at 13:00 UTC on 12/01/22

Poll

For: Action taken if this proposal is accepted.

Against: Action taken if this proposal is rejected.