Summary

Authorize the following changes to the RBS system:

Globally tighten spreads to 7.5% cushion and 15% wall spread

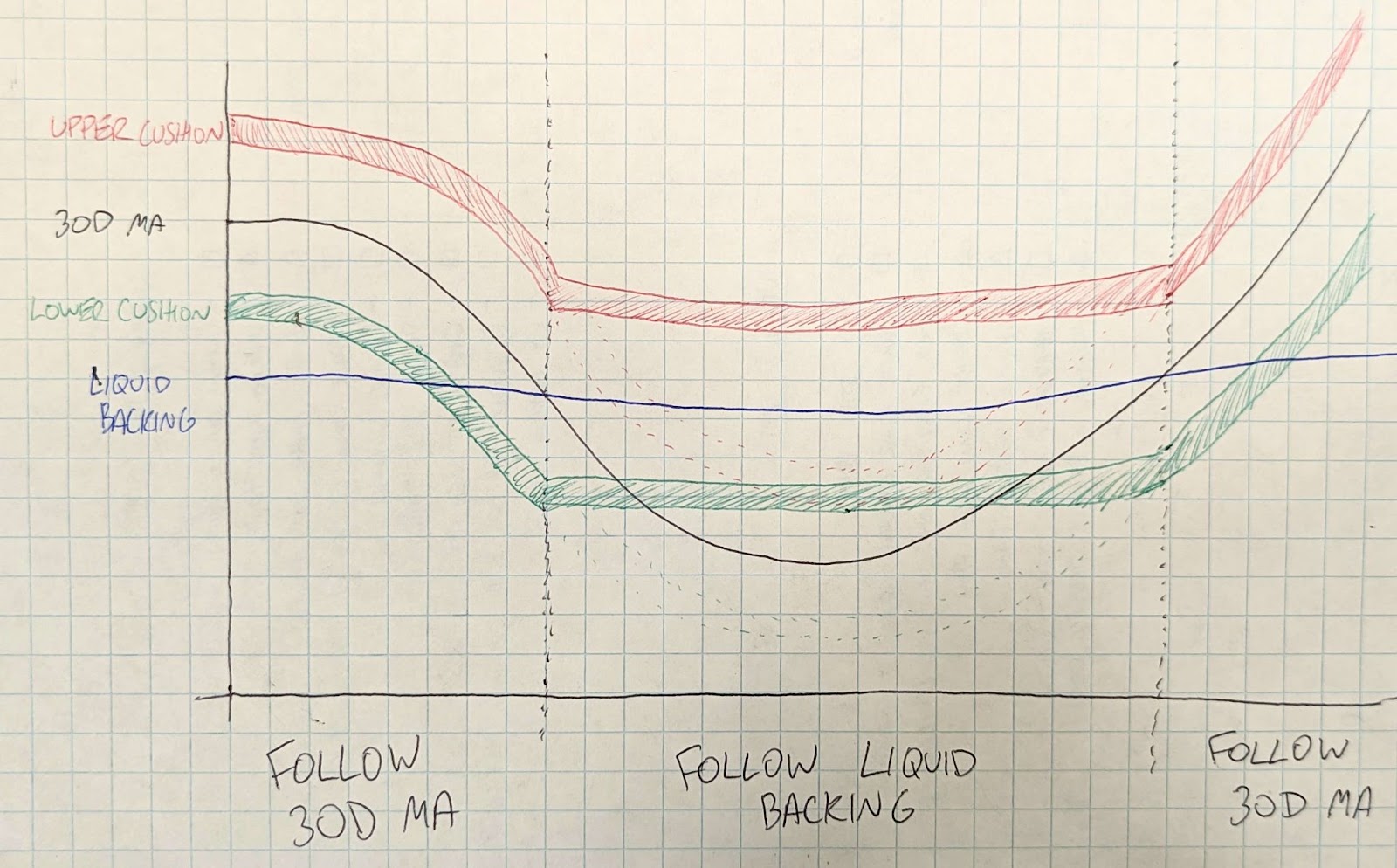

Logic change: If 30D MA is below liquid backing, set target price to liquid backing AND regeneration time to 0

Logic change: If 30D MA is above liquid backing, set target price to 30D Moving Average (MA) AND regeneration time to 18/21 epochs

Also authorize the Policy MS to optionally launch an Inverse Bond market at its discretion to encourage price to move above the new Lower Wall as needed. If needed, this market would launch before the above changes take place.

Context and Motivation

The Range Bound Stability (RBS) system launched on 18 November, and has operated very well with support cushions being activated a few times to reduce volatility. A key takeaway so far has been that the market seems to be supporting price in the cushions before they are activated by RBS. A good example of this is in the price action on 26 November at 1700 UTC. A single massive sell pushed price into the cushion zone, but other market participants “bought the dip” and moved price back into the range. This happened without expending any Treasury funds.

However, during this time the target price (currently the 30d MA of OHM price) has continued to decline. As a result, the cushions continue to trend downwards. Treasury support moves lower and the resistance (sell) cushion and wall are now below backing. This trend is not ideal, as it really doesn’t make sense for the Treasury to sell OHM below backing. It’s purely dilutive to the Treasury and OHM holders, and suppresses price movement to a point of premium. Following the 30d MA this far below backing also shows us a point of improvement for the system: since the Treasury can infinitely support price below backing, and it’s clear that the market will help support the Treasury while in the cushions, it makes sense to follow the Liquid Backing figure as the Target Price instead of 30d MA, while the MA is below backing.

Reminder: the spirit of launching RBS is to find the optimal parameters for all scenarios that RBS could encounter. This OIP is intended to be a step towards optimizing Treasury utilization and market performance in a global bear market scenario. We can further tune these parameters if we find after implementation that the market isn't responding as predicted here.

Implementation Notes

The minimumTargetPrice variable will be manually passed into the contract, set to the Liquid Backing price for the launch of this OIP. Following Liquid Backing in an automated way requires the Liquid Backing figure to be available on-chain. This can be done either with a direct calculation, or through an Oracle. These two options will be explored but are not ready yet, so to start the Policy will periodically update this number. Once the DAO finds a suitable automated method, we will transition to that.

The new proposed Lower Wall would be around $8.87, which could be above the market price of OHM at the time of launch. This is not a bad thing, it just creates an easy arb for an individual to profit off of. In order to facilitate fair and smooth price action leading up to the launch of these changes, the DAO is asking for permission to launch an Inverse Bond market ahead of time on an as-needed basis. This may not be needed if price organically meets the Lower Wall beforehand.

Regeneration time of 0 means that the Policy MS will be able to regenerate the lower wall capacity instantly. This should be automated in the future, in the same spirit as the minimumTargetPrice above. Since the Lower Wall effectively has infinite capacity while below Liquid Backing, it should serve as a “floor” while OHM trends below Liquid Backing.

Restore regeneration time to 18/21 epochs (as it is currently) when the MA goes above backing. While OHM price is above Liquid Backing, the Treasury could theoretically run out of funds trying to support the market with the Lower Cushion and Wall. This is the main reason to reinstate the original regeneration time to 18/21 epochs while above backing.

TL;DR Picture

Poll

The poll will be active for 72 hours. If passed, this OIP will move to Snapshot for 72 hours.