Summary:

Whitelist the Opyn Crab V2 Strategy for Olympus treasury deposits. The goal of these vaults is to allow ETH exposure to increase decentralization but reduce the overall volatility of ETH. We plan to only maintain a small portion of ETH in this position to better understand how Opyn Crab V2 can perform against the broad market.

Background:

OIP-20 defined a framework for Olympus where 33% of excess treasury reserves can be deposited to earn yield in whitelisted protocols. This proposal seeks to add Opyn’s Crab V2 Strategy to this whitelist while keeping the same 33% treasury deposit cap. As this is a whitelist proposal, a risk analysis was performed and can be found below.

About Crab:

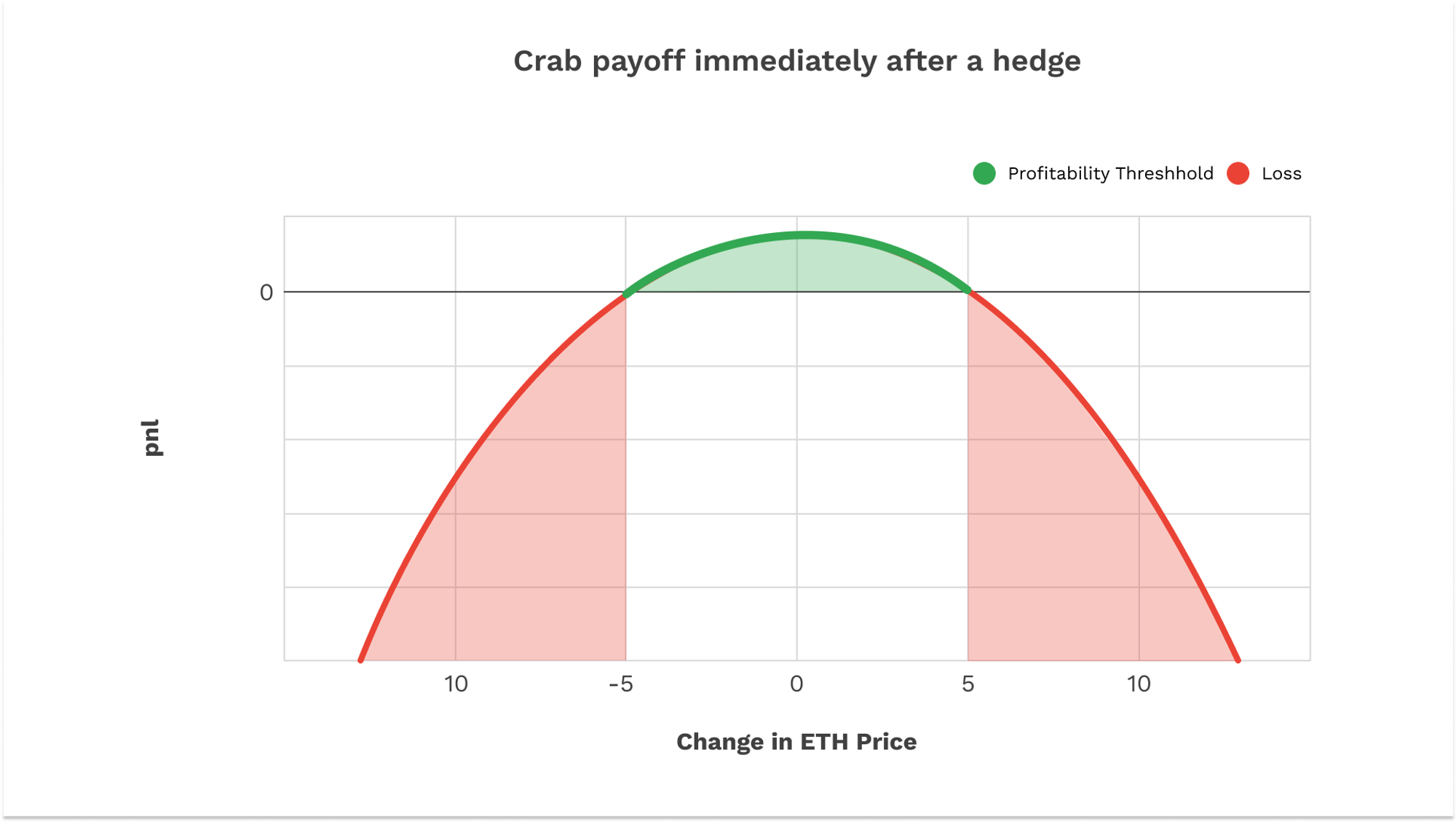

Opyn is a DeFi options protocol and the team that designed and developed the smart contracts for Squeeth, a power perpetual tracking ETH2 in the form of the ERC-20 oSQTH. Crab is an automated short-volatility, delta-neutral vault strategy that allows depositors to reap the benefits of shorting oSQTH without taking a view on if the price of ETH will move up or down. By creating a mix of oSQTH debt and ETH collateral, Crab earns returns in USD terms when price of ETH fluctuates within a relatively stable range with periods of low volatility (compared to market expectations). The vault regularly rebalances via a recurring batch auction that allows Crab to buy or sell a target amount of oSQTH to neutralize delta

More about Crab V2:

Motivation:

Crab V2 provides a short volatility, delta-neutral strategy that aims to earn returns on the treasury’s plethora of idle ETH assets. Delta-neutrality can allow the treasury to earn USD-denominated returns without taking a position on the price of ETH itself. The treasury is currently long ETH and recent market fluctuations have frequently oscillated the dollar value of the treasury. The delta-neutral strategy aims for (1) rapid drops in ETH price to have a less significant impact on the Olympus treasury’s dollar value and (2) generating USD-denominated returns when ETH moves less than people’s expectations (between hedges).

Risks:

Vulnerability: A vulnerability in the Crab V2 or Squeeth smart contracts could lead to partial or complete loss of funds. Crab V2 has been audited and is insured by Sherlock and Squeeth has been audited by Trail of Bits and Akira.

Liquidation: While Crab Strategy deposits can be liquidated if it falls below the safe-collateralization ratio of 150%, rebalancing on a time-based or ETH-price-changes threshold helps prevent a liquidation from occurring. Crab has never been liquidated to date.

ETH Price Movement & Volatility: If there are changes to implied volatility or the price of ETH moves by more than is implied by the Squeeth funding, Crab can lose money.

Slippage: Crab can experience slippage when rebalancing (depending on clearing price from the batch auction) or due to price impact when deposits trigger a Uniswap sell.

Protocol Analysis:

Using a risk analysis framework developed by the DAO, the Policy and Partnerships teams have attempted to score various protocols based on some subjective and non-subjective data.

https://docs.google.com/spreadsheets/d/10rSv9DBA0l2RdgeQ1Lg2DkB-Rusl7ssW7h9qQTMcuRE/edit?usp=sharing