Summary

Adjust reward rate to 0.1186%, the minimum of the current range according to OIP-18, which translates to around 266% APY. This adjustment will be spaced out across 21 epochs, with the reward rate adjusting each epoch. The change will extend Olympus’ runway, improve protocol sustainability and maximize the impact of Inverse Bonds, allowing Olympus to better manage potential lengthy bear market conditions.

Motivation

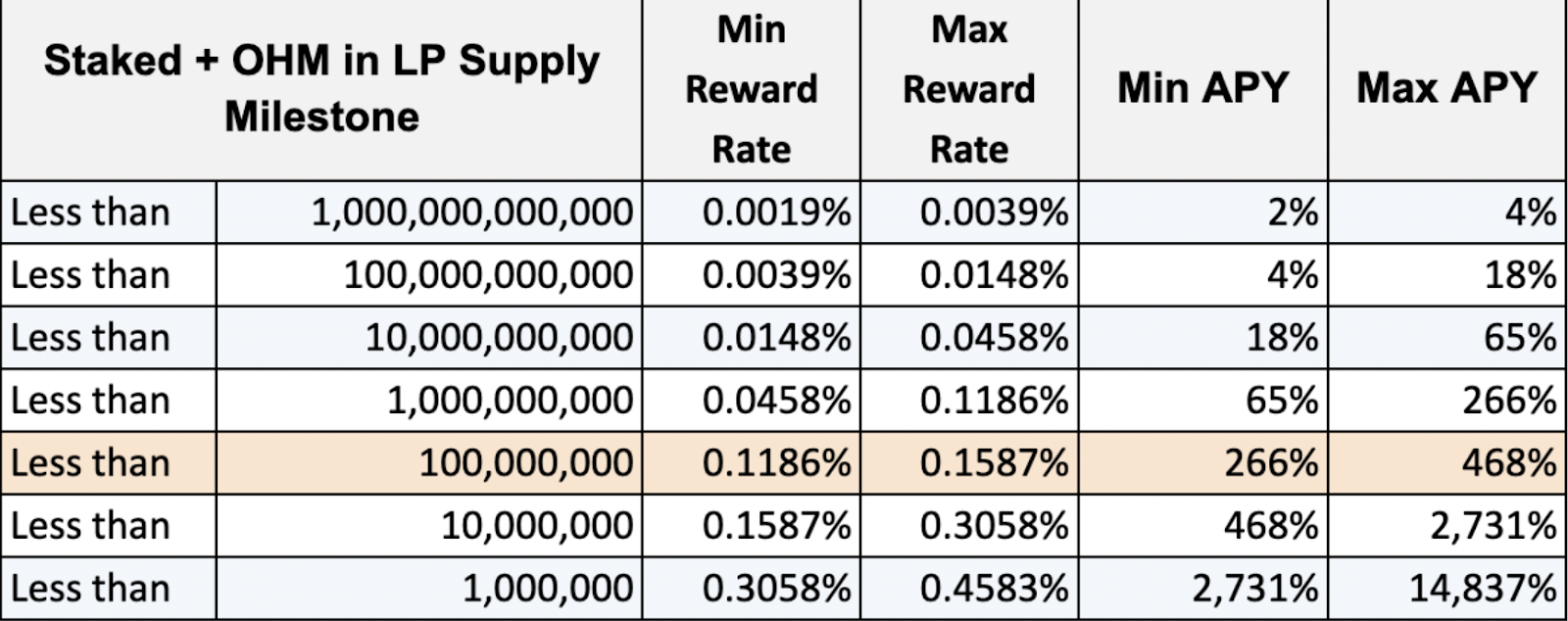

Our current reward rate tier is highlighted in the chart below:

The past few months have shown us a few things.

For one, Ohmies remain strong together. The number of staked OHM is still hovering around 80%, and inverse bonds are cushioning the market from irrational sells. The spirit of 3,3 has never been more important.

Second, the bear market may potentially extend over a multi-month to multi-year time frame. Our goal is to put Olympus and OHM in the best possible position to not only survive the bear market, but thrive. Part of this strategy is to calibrate the network’s growth rate to overall demand for OHM, in order to maintain healthy market conditions. The ideal balance for the market is for supply growth to closely track the growth of the ecosystem over the long term. In the stability phase of OHM, during times of low demand, supply growth should slow as well. A well-balanced emissions rate that tracks with demand for OHM has the following benefits:

1. It makes market operations (specifically Inverse Bonds) more efficient

2. It helps to dampen OHM volatility, which benefits OHM users (individuals, protocols and others), and makes OHM an attractive reserve asset

3. It ensures that the protocol can continue to back and support each new OHM for years to come.

To that end, the DAO is working on an updated Reward Rate framework. Our goal with the new framework is to make reward rate adjustments more aligned with changing market conditions, overall OHM demand, and set up to be automated in the future.

In the meantime, Olympus DAO proposes a reduction in the current reward rate to the lowest end of the current rate tier. A lower reward rate at this time provides major benefits for the protocol.

First, the Treasury will fight less against itself. Inverse Bonds effectively cushion the market and remove OHM from circulation. Emitting more tokens just after this operation works against that supply lever, so reducing the reward rate makes inverse bonds more effective long term.

Second, the protocol will emit fewer tokens during a time when OHM demand is lower. This adjustment will bump the runway to over 700 days. Further, it gives room to continue building the Olympus econohmy in 2022 in a sustainable manner, despite significant adverse macroeconomic headwinds.

Proposal

Adjust reward rate to 0.1186%, the minimum of the current range according to OIP-18. That would be a 0.1186% reward rate, which translates to around 266% APY. The adjustment will be spaced out across 21 epochs, with the reward rate adjusting each epoch.

For additional context, be sure to read the previous reward rate proposals and their discussions:

https://forum.olympusdao.finance/d/755-oip-63-reward-rate-adjustment

https://forum.olympusdao.finance/d/77-oip-18-reward-rate-framework-and-reduction

https://forum.olympusdao.finance/d/37-oip-11-reducing-reward-rate

Vote

For: Adjust reward rate to 0.1186% of circulating supply (from the current 0.1587%)

Against: Do nothing