Background:

OlympusDAO has seen an outstanding growth in 2021 in terms of number of ohmies, number of partners, Protocol Owned Liquidity and more generally Treasury assets. Today, the Treasury is composed of hundreds of millions worth of assets waiting to be further utilized to help propel Olympus towards establishing as a central entity in defi.

Because DAOs are by definition decentralized, it’s important that the community has a say in all key decisions. At the same time, as a DAO grows and its operations become more complex, the community may wish to delegate minor or technical decisions to specialized teams, so that the average community member isn’t overwhelmed by relentless voting on matters they might lack the time, interest or technical expertise to carefully consider.

Olympus is — and will always be — a community-run DAO in which key decisions affecting the protocol are made by the ohmies. The Treasury team exists to first propose strategies and opportunities to strategically utilize our assets. The team will then execute on any of the community’s decisions.

For any DAO, it can be hard to determine where to draw the line between decisions the community itself must make and decisions the community should delegate to its specialized teams. However, we think it’s crucial for the ohmies to clarify these rules now to maintain a healthy alignment of expectations among our growing community.

Summary:

Adopt a framework distinguishing (1) key treasury decisions and guidelines that require a community vote from (2) operational levers that the treasury team uses to implement community decisions, in which case the treasury team should act with autonomy.

Motivation:

Olympus is a community-run DAO in which key decisions affecting the protocol are made by the community. The treasury team implements the community’s decisions through a number of tools, the effective use of which often requires both speed and technical knowledge.

On the one hand, it is critical that the community is broadly aligned on key decisions. On the other hand, we believe it would be a mistake to require constant community votes on more technical questions, particularly when these technical questions arise in implementing decisions the community has already made.

Framework Proposal

We propose adopting the table below as a general framework to clarify when the treasury team should take action to implement community decisions, and when it must seek specific authorization.

Because it is difficult to predict in advance every technical treasury issue that may arise, the following list is not intended to be exhaustive. Rather, it should serve as a living document to help everyone in the community understand how decisions are made.

Note that ETH constitutes a reserve asset and will also be subject to the applicable guidelines.

Proposed Guidelines & Allocations limits

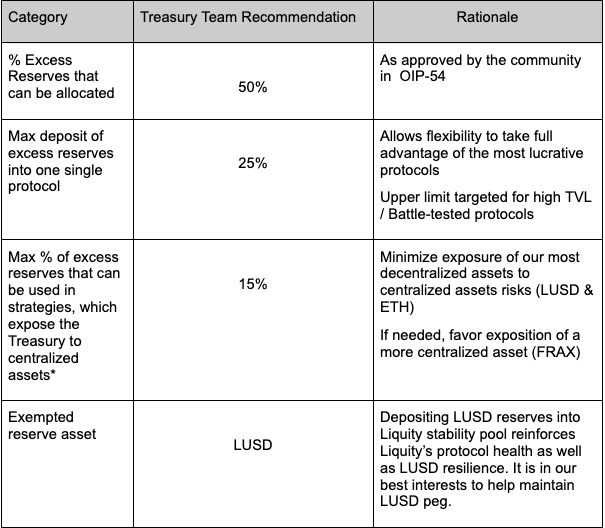

Treasury is also proposing the following guidelines & allocations to the community. Those have been drafted using the Treasury framework presented above as a baseline.

This table will supersede the framework presented in OIP-54.

* While it is not always clear whether an asset is centralized or not, we believe that the strategies targeted by the Treasury team should make that criterion unambiguous. As an example, any treasury asset mixed with 3crv token (USDC,DAI,USDT) would be subject to that allocation limit.

Polling Period

The temperature check process begins now and will run for at least 48 hours. After this, a Snapshot vote will be initiated and open for at least 48 hours.