Policy Report for November 2021

Overview

Over the last month, the Policy team has carefully reviewed market conditions and has been reducing overall bond capacity in light of our stable market cap. Market cap stability has allowed liquidity to catch up and the Policy team has focused this liquidity on the OHM-ETH pair.

This strategy of tightening capacity has had a minor impact on the overall runway, which now stands at about 380 days. The DAI bond capacity is currently being increased to stabilize the runway.

In addition, the Policy team has been working in conjunction with the Treasury team to implement long term strategies that increase non-bond revenues in order to support protocol operations and positively impact the runway. Upcoming reports will show revenue generated by liquidity provision and other revenue generating activities.

Current Reward Rate: 0.298%

The policy team continues to recommend that the reward rate remain at 0.298% in line with the OIP-18 framework.

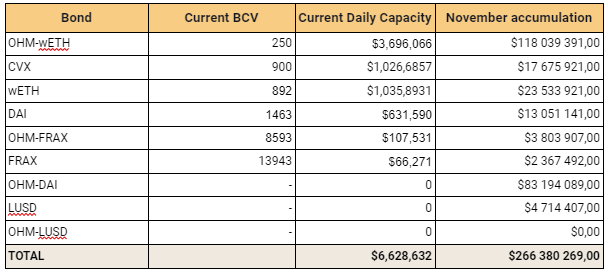

Bonds Capacities

Over the month of November, the treasury has accumulated an additional $266M (at current price) of assets through its bonding program. Total daily bond capacity is currently at $6.6M. The last month has also seen community votes to add OHM-wETH and WBTC bonds. OHM-wETH bonds are live and $118M has been bonded so far. WBTC will go live as soon as the smart contracts are deployed and activated.

Strategic Policy Considerations

Over the month of November, the Policy team discussed the following issues:

Maintaining the balance of Treasury assets utilized to back/mint OHM and continuing to favor assets that are crypto native and highly decentralized/censorship resistant

Acquiring and leveraging strategic assets, which has begun with CVX bonds

Communicating Olympus’ overall strategy, especially as the focus moves from bootstrapping (high APY), to revenue generation and long-term protocol sustainability

Addressing the specific steps being taken to make Olympus’ DeFi’s reserve currency, and how to communicate this activity and the evolving strategy to our community

In addition, from a strategic perspective, it is Policy’s intention to:

Expand Olympus’ current (conservative) strategy of minting OHM using stablecoins with the addition of non-pegged assets. This is to provide greater flexibility in how treasury stablecoins are deployed for yield as well as relying less on the acquisition of stablecoins to extend the runway. We are currently working on proposals related to this strategy.

Implement strategies that enable Olympus to increase the contribution of non-bond revenue to protocol operations and sustainability

Links to more information, further discussion and new proposals

Live Policy Dune Dashboard

#policy channel on Discord

New proposals in the Forum

OIP-41 - Launch Olympus Incubator program

OIP-42: Insurance coverage for smart contracts - rewards distribution

OIP-43: Launch CVX Bonds

OIP-44 Implement Lobis as a governance arm of OlympusDAO

OIP-45: Proteus

OIP46 - Implement [REDACTED] as an Olympus Branch

OIP-47: Olympus Stopgap Budget Proposal

OIP-47A: Amendment to Olympus Stopgap Budget Proposal

OIP 48: Additional DAO Swap with Tokemak

OIP-49A: Olympus Give Lighthouse Partnership with Gitcoin (Amendment)

OIP-50: How the DAO Should Handle Charitable Donations

OIP 51: Strategic Asset Whitelist

OIP 52: Add UST to the Treasury

OIP-53: Execute DAO swap with Frax Finance

OIP-54: Stablecoin Farming Amendment

OIP-55 - Olympus Grants Program

Ongoing forum discussions

Market Making Proposal from GSR

Ongoing snapshot votes

OIP-50: Ban charitable donations using DAO controlled funds

OIP-52: Add UST to the Treasury

OIP-53: Execute DAO swap with Frax

OIP-54: Stablecoin Farming Amendment