Summary

Deploy the new system of Permissionless Olympus Pro contracts as an independent entity rebranded to Bond Protocol. By releasing Olympus Pro as its own protocol, OlympusDAO can focus on making OHM the decentralized reserve currency for Web3 and benefit from supporting the econOHMy. Bond Protocol will remain tightly aligned with OlympusDAO and include the same Olympus Pro contributing team.

Background

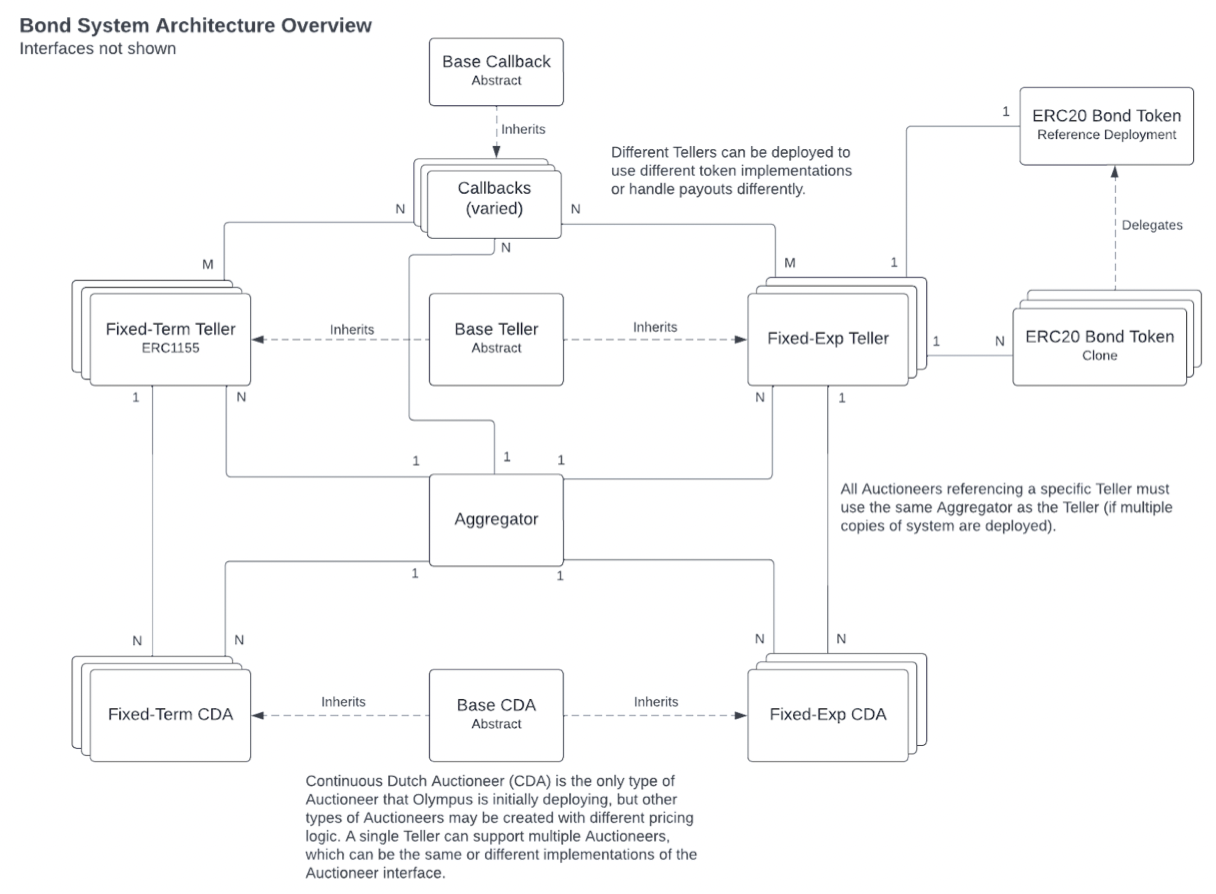

Since launching Olympus Pro, we were able to find product-market fit and kick off a wave of liquidity-as-a-service competitors. We worked with over 50 protocols on 7 chains to help them bond nearly $150M of assets. This year we have been working with our partners, listening to their feedback, and developing the next iteration of Olympus Pro to resolve common pain points. The new set of contracts are:

Permissionless - anyone can create a bond market

Composable - bond purchasers receive a token that represents their position. This will allow for the creation of secondary markets and additional composability in DeFi

Modular - unified contract architecture allows for new types of bond markets to be plugged into the system

Flexible - handles a wide range of token types and relative price differences

Efficient - fewer contract deployments per partner resulting in substantial reduction in gas costs

While incorporating these improvements, it became clear that the new set of contracts could be deployed as its own protocol and become essential Web3 infrastructure.

Motivation

In order for Olympus Pro to scale and meet the demands of DeFi, it must be a credibly neutral platform laser-focused on bonds-as-a-service. There is an increasing divergence between the development efforts of both a reserve currency and a dedicated bond platform. We believe that an independent bond protocol will attract additional development talent, funding, and provide an avenue to accelerate features that enhance Olympus’ bond capabilities.

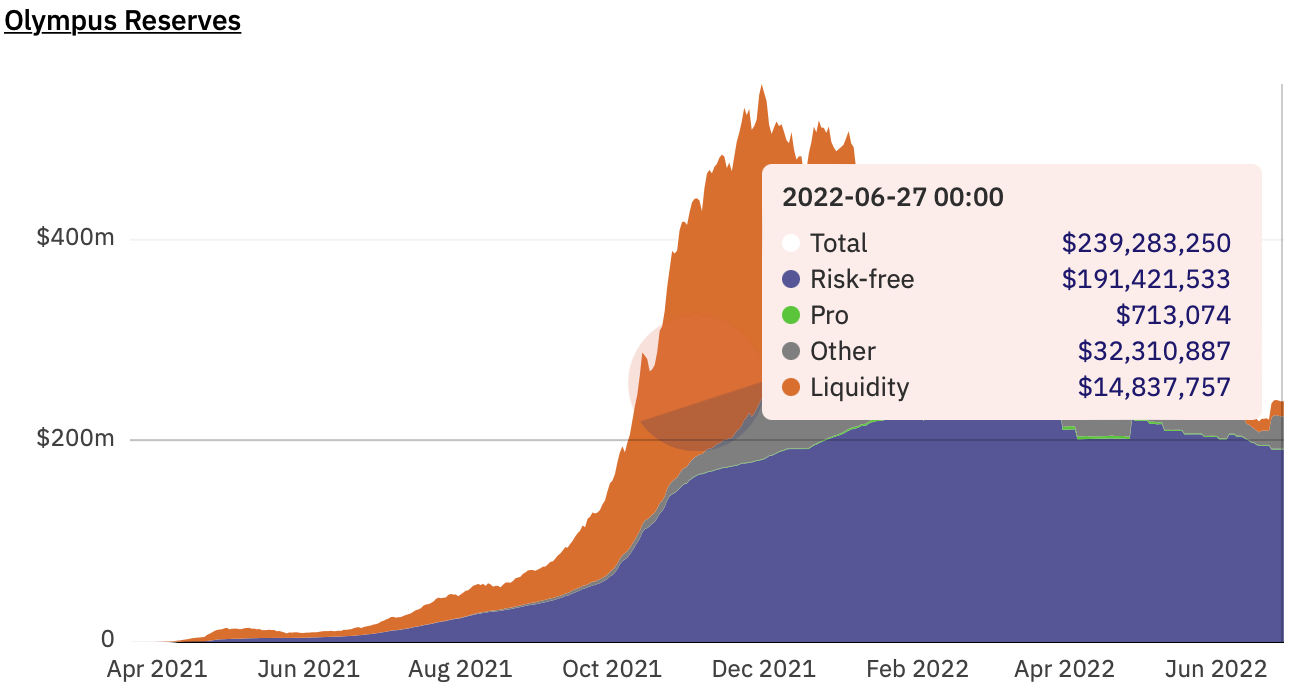

Assets acquired via Olympus Pro are an important, but relatively small, percentage of overall Olympus holdings and revenue streams. By deploying OP as its own protocol, we believe that it will provide more value to Olympus than keeping it in-house and allow Olympus Pro to achieve a true appraisal of revenue streams and growth potential. This will also clarify business development domains and allow Olympus to increase focus on core products (ex: Ranged Stability, Incur Debt).

^ Note that the above chart does not reflect cross-chain Olympus Pro revenue or revenue denominated in several RFV/Strategic assets (ex: DAI, wETH)

Proposal

If approved, the Permissionless OP contracts will be deployed as an independent entity and rebranded to Bond Protocol. Functionally this involves deploying the contracts with a different multisig authority, to be managed by - 2 Olympus Core members, 2 OP members, and 1 external public figure.

Off-chain, Bond Protocol will look and feel like a Web3 tech startup. On formation, Olympus will own a majority of shares (at least 60%). Olympus will also have a seat on the company’s board of directors. With a majority share and board seat, fundraising terms will require sign-off from Olympus prior to diluting its equity.

For the purpose of this proposal, the Olympus board seat will be filled by a member of the Council and represent the collective voice of the DAO. Startup boards are typically small with Bond Protocol's board to have 3 seats - myself, an Olympus rep, and a future investor rep.

Olympus will use the newly formed Bond Protocol contracts for its bonds. This set of contracts are effectively Bonds v3, which have been developed with Olympus in mind as the largest customer. Importantly, there will be no fees charged for Olympus bonds deployed from Bond Protocol.

The initial deployment of Bond Protocol will include two types of bond markets:

Fixed-term bonds tokenized as ERC1155 NFTs (most similar to previous bonds)

Fixed-expiry bonds tokenized as ERC20, same expiry date makes bonds fungible

Amendments

OP Contracts & Revenue

Structure

- Any proposed share allocation at formation will be provided to Council for consideration and, if considered contentious, require further consultation with community governance

- Following formation, the board will provide the Olympus board representative with at least 10 days' notice prior to consideration of a resolution for distribution of unallocated shares

How does OlympusDAO benefit?

OlympusDAO has been undertaking an effort to focus on its core mission - to make OHM the decentralized reserve currency for Web3. By releasing Olympus Pro as its own protocol with its own mission (bonds-as-a-service), Olympus further focuses on its core product while demonstrating a track record of supporting the econOHMy.

Olympus has made a large investment in developing Olympus Pro, while OP has accrued significant revenues to the Olympus Treasury. With OP revenue growth slowing in recent months due to market conditions, releasing Bond Protocol will provide alternative avenues of growth and conserve runway for core OlympusDAO development. Olympus will benefit from Bond Protocol’s success and maintain substantial influence in its development through ownership and governance rights in Bond Protocol.

Polling Period

The polling period begins now and will end on Monday, July 11th at 22:00 UTC. Afterwards, this OIP will be added to Snapshot for a final vote.

Poll

For: Deploy Permissionless OP as Bond Protocol

Against: Do not deploy Permissionless OP